The story of this short-term rental operation is a testament to the impact of strategic adjustments and the introduction of dynamic pricing through PriceLabs. Here’s a breakdown of the remarkable transformation over the past month:

Initial Steps and Changes

• On December 23rd, the team implemented PriceLabs, a dynamic pricing tool, to optimize nightly rates and capitalize on demand trends.

• This change was critical during a period when revenue and occupancy had been underwhelming.

Metrics Before and After Implementation

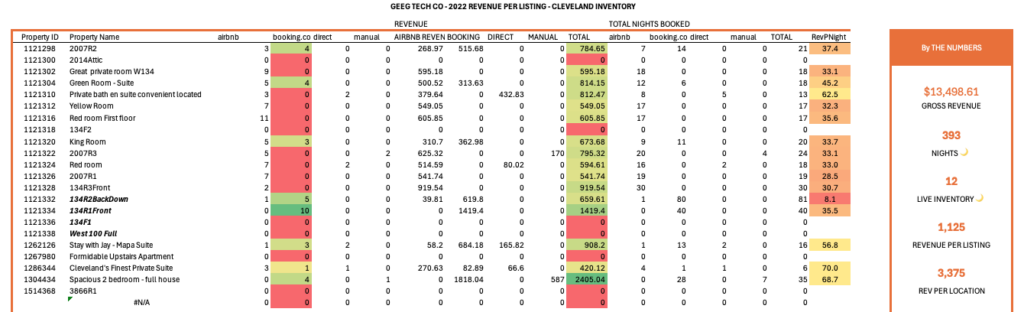

Two Weeks Before PriceLabs Activation (December 9–22):

• Total Revenue: $3,582.53

• Number of Reservations: 19

• Revenue per Reservation: $9,185

• Occupancy: 41%

• Revenue per Available Night (RevPAN): $14.68

• Average Nightly Rate: $57.57

Two Weeks After PriceLabs Activation (December 23–January 5):

• Total Revenue: $9,645.00

• Number of Reservations: 71

• Revenue per Reservation: $135.85

• Occupancy: 69%

• Revenue per Available Night (RevPAN): $38.42

• Average Length of Stay: 3.06 nights

Key Observations

• Revenue Growth: A staggering increase in total revenue from $3,582 to $9,645, nearly a 170% improvement.

• Occupancy Boost: Occupancy surged from 41% to 69%, demonstrating improved market alignment with demand.

• Efficiency Gains: Revenue per available night (RevPAN) more than doubled, from $14.68 to $38.42, highlighting the tool’s effectiveness in maximizing revenue opportunities.

Immediate ROI

• Cost of PriceLabs: Under $300 per month, representing less than 1% of monthly revenue.

• Revenue Increase: Generated an additional $6,062.47 in two weeks, yielding an immediate and substantial return on investment.

Insights and Opportunities

This success has revealed several actionable takeaways:

1. Dynamic Pricing Works: The immediate revenue increase validates the use of dynamic pricing for market-responsive adjustments.

2. Further Optimization: The data highlights opportunities to refine other operational aspects, such as targeted promotions for extended stays or low-demand periods.

3. Scalability: For less than 1% of revenue, the investment in dynamic pricing is not only sustainable but also a catalyst for long-term growth.

Conclusion

Turning on PriceLabs has already proven transformative for this operation, unlocking revenue potential that had been previously untapped. This client now has a clear path forward, leveraging tools and insights to build upon this early success and drive continued profitability.

Next Steps and Strategic Focus

Building on the early success of implementing PriceLabs, the next phase for this project focuses on sustainability, refinement, and strategic growth. Here’s a detailed breakdown:

1. Continuous Monitoring and Analysis

• Key Metrics to Track:

• Nightly Rates: Ensure they align with demand fluctuations and competitor benchmarks.

• Revenue per Available Night (RevPAN): Focus on maximizing this metric to maintain profitability.

• Tools and Training:

• Equip the client with the necessary tools and knowledge to independently monitor and interpret these metrics over time.

• Implement dashboards or reports from PriceLabs to simplify ongoing analysis.

2. Leveraging PriceLabs for Market Trends

• Dive deeper into PriceLabs’ wealth of information, particularly its marketing analysis features, to:

• Identify seasonal patterns and prepare for peak and off-peak adjustments.

• Pinpoint emerging trends in the short-term rental market to stay ahead of competitors.

• Optimize strategies for the future state of the local market, not just its current dynamics.

3. Pivoting Into B2B

The client has an opportunity to expand beyond traditional B2C short-term rentals into B2B offerings:

• Corporate Partnerships: Target businesses needing lodging for traveling employees or extended stays.

• Event Hosting: Explore opportunities in hosting business-related events or retreats.

• Custom Packages: Create tailored offerings for corporate clients that align with their specific needs.

4. Detailed Cost Analysis

Understanding and optimizing costs is crucial for long-term success:

• Identify Fixed vs. Variable Costs:

• Fixed costs (e.g., property maintenance) that exhibit fluctuating utilization should be reassessed.

• Maximize the use of excess capacity to spread costs across more revenue-generating activities.

• Benchmark Cost of Goods Sold (COGS):

• Accurately calculate COGS to identify inefficiencies or areas where costs can be reduced.

• Leverage economies of scale for recurring expenses.

• Make Costs More Variable:

• Shift fixed costs into a more variable model where possible, ensuring expenses scale with demand.

• For example, flexible staffing or subscription-based services for maintenance and supplies.

5. Capacity Utilization Strategy

For fixed costs with underutilized capacity:

• Redirect excess capacity toward alternative revenue streams, benefiting all stakeholders.

• Examples include:

• Offering professional cleaning or maintenance services to other operators.

• Leveraging available property spaces for co-working, pop-up events, or storage rentals.

Vision for the Future

This effort is part of a broader transformation for the client, focusing on:

• Agility: Adapting to market trends and shifting demands.

• Sustainability: Building a robust financial model with optimized costs and diversified revenue streams.

• Scalability: Creating a blueprint that can be applied to other properties or markets.

The ultimate goal is to position the client as a forward-thinking leader in their local short-term rental market, capable of not just reacting to current conditions but actively shaping the future landscape.

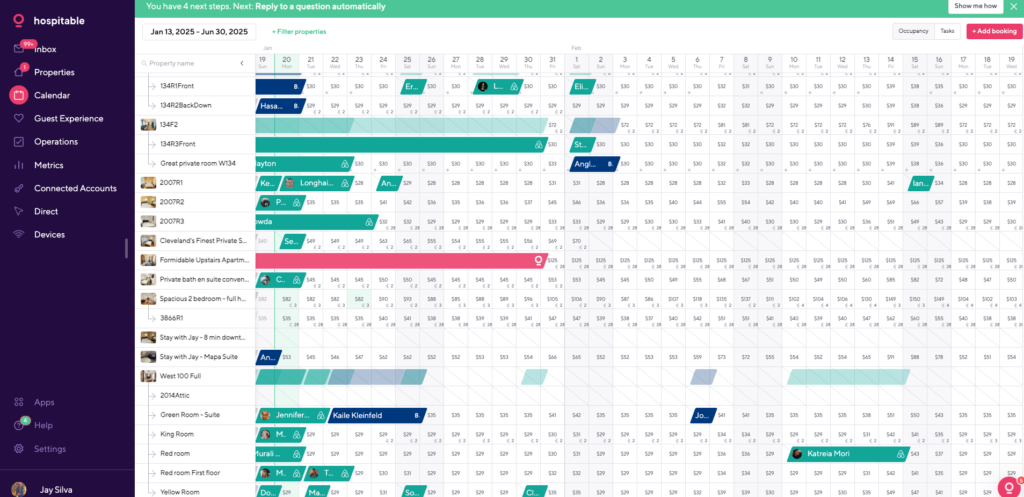

Customizing Pricing Profiles

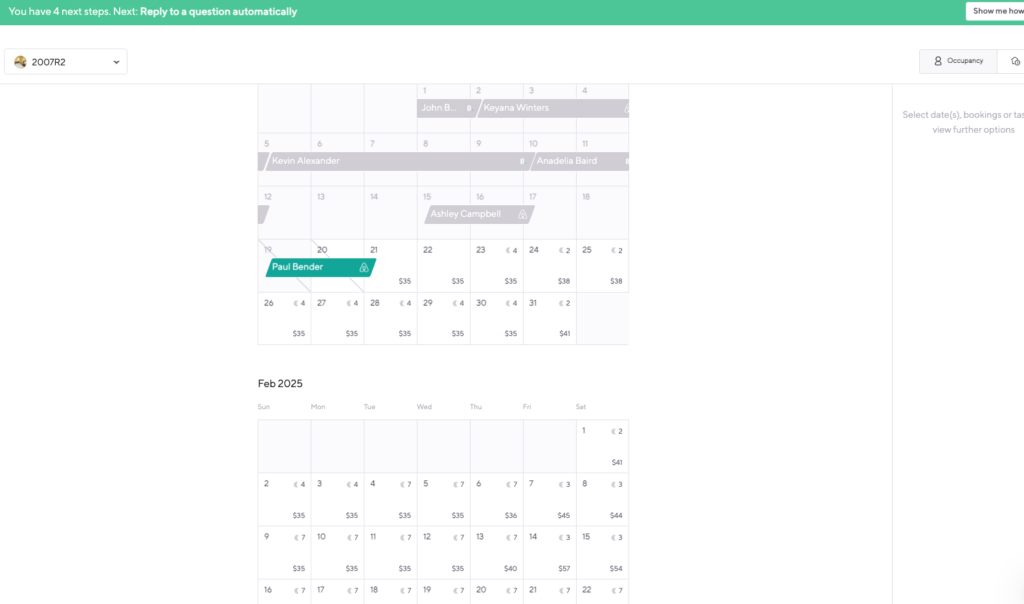

Focusing on 2007

R2 x 2007R1 these are very similar rooms. Almost carbon copy in amenities, location, etc.

After customizing the profile and pressing update, the prices on the overall calendar change almost immediately. What we are focusing on the pricing change here, is the minimum nights that are showing on the calendar itself.

This provides a zoom

45 Days Check

Since implementation the client was experiencing less than 65% occupancy. Since implementation and certainly for the last 30 days over 50% of all listings are experiencing an occupancy of 92% , while the general population is experiencing an occupancy of 90%. So everything is over 90%, with a handful of 5 rooms at 100%

Recommendation:

Recommendation:

- Add Cleaning Fee back to all rooms.

- Increase the Base Price in PriceLabs to gradually increase the Rev Per Night by at least 2 dollars for the remainder of February.

Adjusting one specific listing